In times like these, standing out from the crowd and grabbing your audience’s attention through unique content is essential.

Fortunately, the introduction of Artificial Intelligence (AI) has completely transformed the content creation field.

This article explores five AI tools that have revolutionized the way content is created to be unique. These tools empower writers, marketers, businessmen, and students to add their own personal touch and genuine feel to their work. The tools listed include an online notepad tool, content creation tools, and SEO helpers.

From AI-powered content generation to advanced paraphrasing tools to make your content unique, AI tools provide many possibilities for those who want their content to be impressive.

So, start reading the article to explore the world of AI-driven creativity.

Scalenut.com

Scalenut is your one-stop solution for all your content needs, from generating ideas to optimizing for SEO.

You can use Scalenut to create high-quality content for various formats, from blog posts and articles to social media posts and product descriptions.

Using it for content creation can save you time and effort. You can focus on other business areas while your content is being created.

By creating detailed content briefs, Scalenut will help you create well-structured and informative content. It will also suggest ways to improve your content’s structure and the readability of your writing.

Using Scalenut to generate detailed content briefs, you can get feedback on how your writing is coming out, as well as suggestions on improving the grammar, style, and clarity of your writing.

So, it is a great tool for crafting supreme content. Whether you are a small startup or a large enterprise, Scalenut caters to businesses of all sizes.

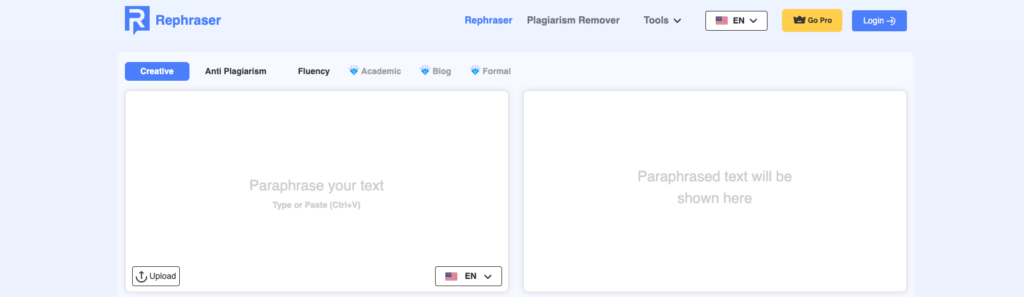

Rephraser.co

Rephraser.co is an absolute game-changer for content writers. This AI rephrasing tool has the incredible ability to generate a different version of your content, all while preserving the original meaning.

This means you can effortlessly create different versions of your articles or blog posts for various platforms or audiences.

But that’s not all. This rephraser online tool also plays a crucial role in helping you avoid plagiarism and make your content unique.

It uses its state-of-the-art algorithms to use different words and sentences to make sure that your content is not a copycat of any existing content.

While ensuring your text is unique, rephraser.co tries to keep the key concepts and ideas inside your content so your message remains consistent and cohesive.

Additionally, this rephrasing tool makes your text easier to read, whether you are writing for a wide audience or for someone who does not speak English fluently.

To meet your diverse needs, it provides six distinct rephrasing modes. These modes, namely Creative, Anti-Plagiarism, Fluency, Academic, Blog, and Formal, offer you the flexibility to choose the most suitable approach.

By utilizing any of these modes, you can rephrase text to make it both plagiarism-free and captivating.

Most importantly, creates content resembling human writing without requiring manual composition. With this remarkable tool at your disposal, you can effortlessly produce authentic, original content free from any traces of plagiarism.

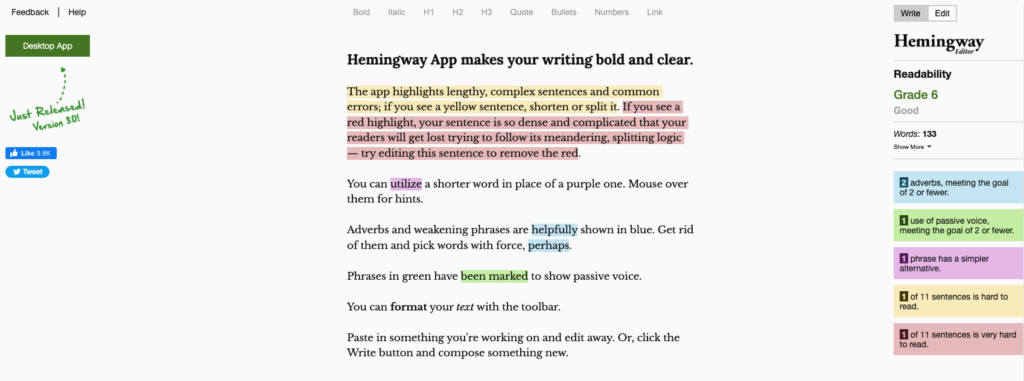

Hemingway Editor

The Hemingway Editor is a useful AI tool for enhancing the uniqueness, readability, and accessibility of your content. It effectively highlights adverbs, passive voice, and complex sentences, allowing you to identify and remove these elements for a more concise and readable writing style.

By eliminating adverbs and passive voice with the help of the Hemingway Editor, your writing becomes more engaging and distinctive.

Moreover, the tool assists in identifying and replacing complex words and phrases with simpler alternatives, enhancing accessibility and uniqueness.

It also analyzes the readability of your content and provides a score, helping you identify and address any areas where your writing may be difficult to comprehend.

The Hemingway Editor’s readability score is valuable for pinpointing areas in your content that may require improvement.

Therefore, it is an invaluable resource for anyone seeking to enhance the uniqueness, readability, and accessibility of their content.

Grammarly

Are you tired of submitting content that is riddled with grammar, spelling, and punctuation errors?

Do you want to make your writing more engaging and professional? Look no further than Grammarly!

Grammarly is a powerful AI tool that can help you identify and correct errors in your writing. Not only that, but it can also suggest improvements to your writing style, making it more concise and effective.

With Grammarly, you can ensure that your content is original and unique, avoiding any accusations of plagiarism.

It is easy to use, making it accessible to anyone who wants to improve their writing.

Grammarly provides synonyms and alternative words to enhance the language choices in your content, making it more distinctive and captivating.

The tool suggests adjustments to match the tone and style of your content with your target audience, enabling you to personalize your writing with a distinct and individual voice.

By promoting clear and concise writing, the tool assists in effectively conveying ideas, setting your content apart for its straightforwardness.

Yoast SEO

Last but not least, Yoast SEO is a WordPress plugin that can greatly enhance your content’s search engine optimization (SEO) and make it unique.

One of the key benefits of Yoast SEO is its ability to assist you in creating compelling title tags and meta descriptions for your pages and posts.

These title tags catch the eye in search results, while meta descriptions provide a concise summary below them.

Yoast SEO ensures that your title tags and meta descriptions are the appropriate length and contain the most relevant keywords.

In addition, Yoast SEO aids you in effectively incorporating keywords into your content. It offers suggestions for relevant keywords and phrases to include in your title tags, meta descriptions, and content.

By doing so, it helps you avoid the detrimental practice of keyword stuffing, which can negatively impact your website’s search result rankings.

It assists you in structuring your content in a search engine-friendly manner.

Up to You

Now, you have a better idea of how to use the above-mentioned tools to craft unique content. We hope you find this article quite informative.

We hope that this article has provided you with valuable insights.

So why delay any further?

Incorporate these AI tools into your arsenal and produce exceptional content that captivates your intended audience.

The post Best AI Tools That Help You in Making Your Content More Unique appeared first on noupe.