Gifting your loved ones something of their choice can be the best thing you can do for them. But, for most customers, it is quite challenging to choose such gifts. The e-gift cards come to rescue the shoppers in such circumstances.

If we look at the research done by Businesswire, the Global Gift Card Market is estimated to be $845.39 billion in 2022 and is forecasted to reach $2021.64 billion by the end of 2027, growing at a CAGR of 19.05%. So you can see the Global Gift Card Market will continue to grow in the future.

Suppose you have an online store on any popular eCommerce platform such as Magento 2, you should definitely try Magento Extension to Boost sales in Holiday Season.

In this short post, I will discuss everything from the nuts & bolts of e-gift cards to their benefits for your business.

What is An e-Gift Card & How Does it Work?

An e-gift card, also known as a digital or virtual gift card, is a predefined value-containing card that can be used to make a purchase in a brick-and-mortar store or an online store.

The process from purchasing to redeeming e-gift cards should be effortless to give your customers the best user experience.

The process goes like this:

- The first thing you should do is create various e-gift cards that customers can choose from. Manage them in a proper way so customers can explore and filter gift cards as per requirements. You should use a gift card extension to manage your gift cards easily.

- After choosing the gift card, provide your customers with an easy, convenient, and fast method to pay for a Gift Card.

- When customers successfully complete the payment process, a unique gift code should be generated that carries the value of the gift card as per the customer’s selected plan.

- After the unique gift code is generated, you should provide a convenient way to send that code to customers’ loved ones. An easy and secure way to send code is via email and SMS.

- Now finally when an e-gift card is received by your loved ones, you should provide convenient methods to redeem that gift card at an online or physical store.

You should also set user-friendly terms and conditions for the usage of e-gift cards. Like, if recipients have not used all the balance of the gift card in single use, they can use the same card for a second time to purchase any product. This will make recipients return to your store and make their purchase more than the remaining gift card balance.

Purpose of e-Gift Cards in Ecommerce Business

If you want to level up your eCommerce business, visibility and customer loyalty can play a vital role in that, and e-gift cards can provide you with both. An e-gift card holder will surely visit your online store at least once, and grant you the opportunity to make your store more visible. The recipient will come to visit your store and explore your products till he/she gets all the benefits of the e-gift card.

Whatsmore, you can offer some more benefits over these e-gift cards and earn your customer’s trust and make them loyal to your brand.

Benefits of Offering e-Gift Cards in eCommerce

Facilitating your customers with e-gift cards can benefit your business in more than one way, such as:

Grow Sales and Revenue

The most crucial benefit of digital gift cards is that they can increase sales on your online store. People often find it challenging to choose the right gift for their family and friends. Moreover, when time is running out, and last-minute gift purchasing is needed, e-gift cards can save the day!

E-Gift cards can also direct more revenue to your online store. Recipients will probably spend more than the predefined amount of e-gift cards while buying any product. People often use e-gift cards as discount money while purchasing a product with a larger value to prevent paying more significant amounts.

Increase Brand Awareness

Another benefit of the e-gift card is increasing your brand awareness. It might be possible that the recipient has never heard of your brand before. In that case, an e-gift card will make that recipient come and explore your store. There is a high chance that the e-gift card recipient will also consider your brand for future purchases.

You can put your brand’s logo on an e-gift card to make it noticeable. Whatsmore, e-gift cards are not bound to any physical form so they can be sent and shared globally. In other words, it can increase your brand awareness globally.

Get New Customers

When customers purchase e-gift cards and send them to their family members and friends, the e-gift card holders are bound to visit your store at least one time. That gives you a fair chance to make a first impression of your online store. Valuable products with the best offers may catch recipients’ attention, and you will get new customers. This also reduces the customer acquisition cost!

Assured Profit of Unused Cards

Many recipients forget about their e-gift cards, and the cards expire without spending a penny. Whatever the reason, the entire amount the e-gift card holds becomes profit for your business. As per the Creditcards, 52% of Millennials, 51% of Generation Z, 43% of Generation X, and 42% of Boomers of the total US adult population are unlikely to have this kind of unused gift card hanging around with them, and eating dust. The total amount of unused cash is roughly $21 billion.

Right Time to Sell e-Gift Cards

The right time to sell e-gift cards will depend on the customers. People are always looking for e-gift cards with the best offers on various occasions, such as birthdays, promotions, anniversaries, and special days like mother’s day & father’s day.

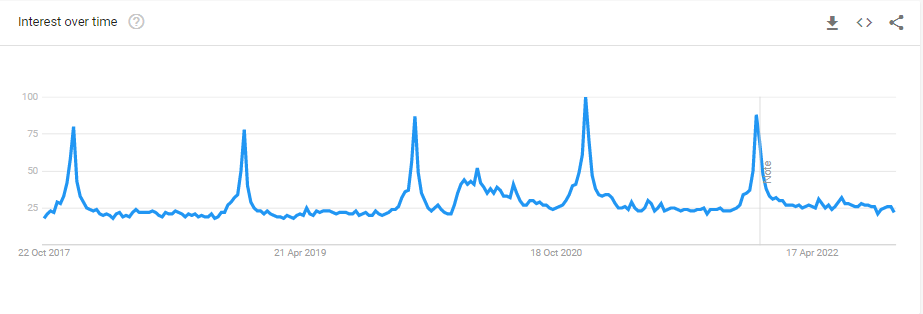

However, e-gift cards have become more demanding at festivals like Christmas and Halloween. You can see a massive jump in e-gift card searches in December for the past several years on Google Trends. Hence, it can significantly boost your business’s sales and revenue if you sell e-gift cards with the best offers in these months.

Wrapping Up

E-gift cards are the perfect and practical gifts you can offer for loved ones! E-gift cards can be a lifesaver when people can’t decide what gift to give to their special one. It can also save a day of last-minute shoppers. Nowadays, almost all brands are providing a range of e-gift cards with various predefined amounts. Offering e-gift cards in your store will surely improve customer experience and grow your business. I hope the above-mentioned benefits are good enough for you to get an e-gift card plugin for your online store.

The post What is an e-Gift Card & How Does it Work? appeared first on noupe.