When you’re dealing with network issues, the go-to solution that often comes to mind is using a ping monitoring tool. Why? Because it’s the quickest and easiest way to check if your servers or devices can talk to each other over the network. It’s like a virtual handshake to see if everything is okay.

Ping monitoring tools help you keep an eye on your internet protocol (IP) and related components. These tools let you manage and watch over your connections, making sure your network is doing its job – keeping systems connected and running smoothly.

By using a ping monitoring tool, you can quickly verify if your connections are working as they should. It’s like a network health check to see if your systems are up and running or if there’s a hiccup.

Now, let’s dive into the world of ping monitoring and explore some of the best tools out there to help you monitor and fix any network hiccups.

How Ping Monitoring Works?

By doing Ping tests regularly, you can figure out the fastest, slowest, and average times for the device to respond. We call this time between sending the signal and getting a response the “ping time,” usually measured in milliseconds (ms). The lower the ping time, the better – it means your network is speedy and in good shape.

Ping monitoring is like sending a friendly signal to a device or computer and checking how quickly it responds. It’s like saying “hello” to see if everything is working smoothly. If the device replies fast, it’s a good ping, but if it takes too long, it’s considered bad.

Here’s the technical bit: ping sends a special message called an Internet Control Message Protocol (ICMP) echo request to a specific spot on the network. When that spot gets the message, it quickly replies with an echo to confirm it got the signal. So, ping monitoring is like a quick conversation to make sure everything is running smoothly in your network.

Top 5 Ping Tools

Here are the top five ping tools that can help spot issues by providing real-time network info.

SolarWinds Ping Monitor Tool

With SolarWinds Ping Monitor Software, you can easily keep an eye on how quickly devices respond. All you have to do is pick the device you want to watch. This software lets you share monitoring data using text files or show it off with images or graphs.

And it’s not just about pinging! SolarWinds comes with a bunch of cool features. You get a WAN Killer Traffic Generator, a MAC Address Scanner, an SNMP MIB Browser, a Ping Sweep, a Subnet Calculator, an MIB Walk, a Switch Port Mapper, and a whole lot more. It’s like having a superhero toolkit for checking and managing your network.

Site24x7

The Network Monitor part of the Site 24×7 is smart. It uses the ping monitor to find all the gadgets connected to your network and creates a list of them. Then, it takes this info and makes a cool map to show you how everything is connected. Regular check-ups make sure this map is always up to date.

Site24x7 is like a superhero for monitoring everything related to your online world – websites, cloud, servers, networks, applications, and even how real users experience your site. It keeps an eye on important things like how fast your site responds and if it’s available, giving you useful metrics. Among the basic monitors in Site24x7, you find ping alongside other friends like HTTP/HTTPS, WebSocket, DNS, and FTP, NTP, or SMTP servers.

PingPlotter

PingPlotter Pro is a great tool for checking how your network is doing. It works on Windows, Mac OS, and iOS, and you can even keep an eye on things remotely through a web interface. This means you can monitor lots of devices from one place.

For a quick look at your network’s health, PingPlotter Pro has summary screens and jitter graphs. These help admins see what’s going on with just a glance at the data. But what really stands out is its traceroute feature.

With a user-friendly interface, it shows you the time it takes for data to travel and any losses that happen along the way. It’s like following a virtual trail of data from point to point, giving admins a clear view of what’s happening in their network and making it easier to spot and fix problems.

Better Stack

Better Stack is like a superhero for keeping an eye on your online stuff. It does a bunch of cool things, like checking if your website is up, managing incidents, and letting people know if there’s downtime through status pages.

With Better Stack, you get checks for all kinds of things – keywords in URLs, multiple verification steps, heartbeat checks, SSL, ping, and port monitoring. It’s like having a virtual superhero squad, making sure everything runs smoothly. Plus, it plays nice with other tools you might already be using, like Datadog, New Relic, Grafana, and more.

Here’s the neat part: Better Stack checks your website every 30 seconds, not just from one place but from different locations. This means no more false alarms or missing issues that depend on where you are.

If something goes wrong, Better Stack doesn’t just tell you there’s a problem – it shows you exactly what happened with screenshots and a timeline. You can use its reports and analytics to look back at how well your site has been doing, check if it meets service level agreements (SLA), and understand incidents better.

iplocation.io

The Ping test tool by iplocation.io is like a handy helper for people who want to check if a website, domain, or IP address is working okay. It’s super easy to use – you just open it, type in the website or IP address you’re curious about, and hit the “Ping Now” button.

After that, the tool gives you some useful info. If everything’s good, and no data is lost, it means the connection is solid, and the thing you’re checking is online. But if there’s data loss, it could mean the connection isn’t reliable.

If the tool times out, it’s like a little red flag. It might mean there’s an issue with the IP address, the thing you’re checking is offline, or there’s something in the way that’s stopping it from responding to ping requests.

Final Words

For IT professionals, it’s crucial to know if their important servers and network gadgets are doing well or if they suddenly go offline. A ping tool is like a helpful buddy in this situation. It constantly sends requests to your important network devices, making sure everything are okay.

Using a ping monitoring app is smart because it doesn’t hog up a lot of your network’s power. This means you can keep your services running smoothly without slowing down your whole network or internet connection. How you set up your ping monitoring depends on what you need, but with a little digging and testing, you can find the best way to keep your network in top shape.

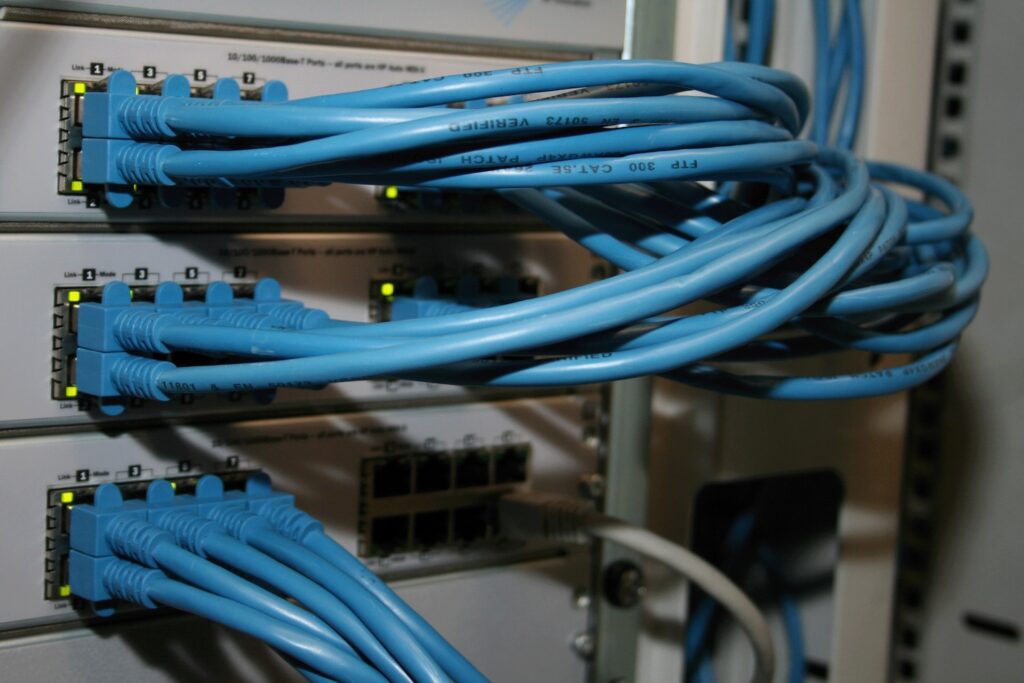

Featured image by U. Storsberg on Unsplash

The post Top 5 IP Ping Tools appeared first on noupe.